My Account

Follow us on:

Find & Invest in bonds issued by top corporates, PSU Banks, NBFCs, and much more. Invest as low as 10,000 and earn better returns than FD

Invest Now

Powered By

Find safe & high-yielding bonds for your buck. Discover the right bonds meeting your investment amount & investment horizon

Invest Now![]()

AMBAREESH BALIGA

Fundamental, Stock Ideas, Multibaggers & Insights

Subscribe

CK NARAYAN

Stock & Index F&O Trading Calls & Market Analysis

Subscribe

SUDARSHAN SUKHANI

Technical Call, Trading Calls & Insights

Subscribe

T GNANASEKAR

Commodity Trading Calls & Market Analysis

Subscribe

MECKLAI FINANCIALS

Currency Derivatives Trading Calls & Insights

Subscribe

SHUBHAM AGARWAL

Options Trading Advice and Market Analysis

Subscribe

MARKET SMITH INDIA

Model portfolios, Investment Ideas, Guru Screens and Much More

Subscribe

TraderSmith

Proprietary system driven Rule Based Trading calls

Subscribe![]()

![]()

Curated markets data, exclusive trading recommendations, Independent equity analysis & actionable investment ideas

Subscribe

Curated markets data, exclusive trading recommendations, Independent equity analysis & actionable investment ideas

Explore

STOCK REPORTS BY THOMSON REUTERS

Details stock report and investment recommendation

Subscribe

POWER YOUR TRADE

Technical and Commodity Calls

Subscribe

INVESTMENT WATCH

Set price, volume and news alerts

Subscribe

STOCKAXIS EMERGING MARKET LEADERS

15-20 High Growth Stocks primed for price jumps

Subscribe

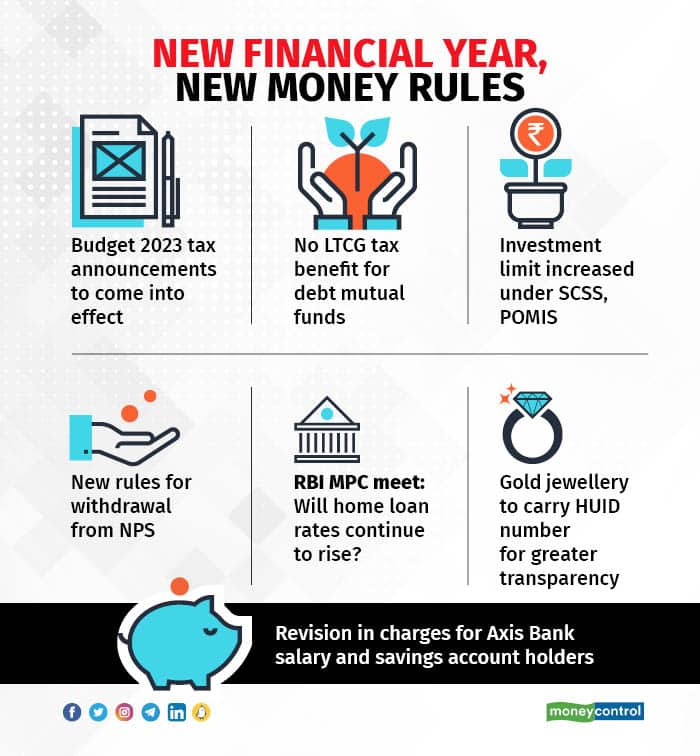

A new financial year is upon us. The start of a financial year is a good occasion to look at your investments and financial goals.

Whether you have a loan or plan to take one, keep an eye on the Reserve Bank of India (RBI) policy announcement. Also, there are major changes in tax rules, in the withdrawal policy from the National Pension System (NPS), and for investments in post-office schemes and more.

So, what are those changes in April 2023 that will pinch your purse?

1 Income-tax rule changes for FY 2023-24

Effective April 1, several changes will affect taxpayers in India because of the income-tax changes announced in Budget 2023. Some of the significant changes are as follows:

The new regime will be the default one, if a person does not state which regime they will submit their returns under. The rebate limit has been increased from Rs 5 lakh to Rs 7 lakh under the new regime. New income-tax slabs under the minimal exemptions regime will also come into force from April 1.

Leave travel allowance encashment limit was raised from Rs 3 lakh to Rs 25 lakh in Budget 2023, effective financial year 2023-24. In line with the Budget announcements, income earned on traditional endowment life insurance policies will be taxable at maturity, if the aggregate annual premiums exceed Rs 5 lakh in a financial year.

Investment in market-linked debentures will be considered short-term capital assets and there will be no capital gains tax, if physical gold is converted to electronic gold or vice-versa.

2 No LTCG tax benefit for debt mutual funds

Debt mutual funds will lose a key tax edge they enjoyed over fixed deposits. From April 1, capital gains made on debt mutual funds — schemes that invest less than 35 percent in Indian equities — will be added to your income and taxed at the slab rate applicable to you.

At present – that is, up to March 31 – capital gains made on debt funds are considered long-term if units are held for more than three years. Such long-term capital gains (LTCG) attract a tax of 20 percent after indexation, which brings down the tax payable. This benefit will no longer be available from April 1. Read Moneycontrol’s analysis here.

Also read: With smarter fund management, debt can still make a difference

3 SCSS and POMIS investment limits enhanced

Budget 2023 has enhanced the attractiveness of two important financial investments, popular among senior citizens. Effective April 1, the maximum limit under the Senior Citizen Savings Scheme (SCSS) has doubled to Rs 30 lakh from Rs 15 lakh.

The scheme offered an assured interest of 8 percent per annum for the January to March 2023 quarter. The interest is paid quarterly.

Additionally, the investment limit under the popular Post Office Monthly Income Scheme (POMIS) has been raised to Rs 9 lakh from Rs 4.5 lakh. In case of joint accounts held in POMIS, the investment limit has been hiked to Rs 15 lakh from Rs 9 lakh. The scheme paid a monthly interest at the rate of 7.1 percent from January to March 2023.

Both SCSS and POMIS have a tenure of five years from the date of investment. SCSS accounts can be extended for three years upon maturity.

A sovereign guarantee backs these schemes, so there is no credit risk involved. These schemes are popular among senior citizens who need a regular income.

4 New NPS rules for withdrawal

The pension regulator, Pension Fund Regulatory and Development Authority (PFRDA), has made the uploading of certain documents mandatory, effective from April 1, 2023, to make annuity payments faster and simpler for subscribers.

The documents that needed to be uploaded on the CRA (Central Record-keeping Agency) system are NPS exit/withdrawal forms, proof of identity and address as specified in the withdrawal form, bank account proof and copy of PRAN (Permanent Retirement Account Number) card.

The CRA system is a web-based application for carrying out NPS-related activities.

You can withdraw 25 percent of your contributions from the account after completing five years in the Tier I account of NPS. You can withdraw for specific reasons – treatment of illness, disability, to fund higher education or marriage of children and for property purchase. The regulator restricts you to withdraw a maximum of three times during the entire period of investment.

5 Another rate hike before taking a pause?

The Reserve Bank of India’s first monetary policy announcement of the financial year 2023-24 is on April 6.

The Monetary Policy Committee (MPC) increased the repo rate by 250 basis points in the financial year 2022-23 to 6.50 percent. One basis point is one-hundredth of a percentage point. The consecutive rate hikes since May 2022 were to control the rising inflation.

Economists expect the RBI to hike the repo rate by another 25 basis points in April before taking a pause.

If there is another rate hike, banks will once again increase interest on home loans and other loans linked to the repo rate as an external benchmark, as per the terms of loan agreements.

Also read | Increase home loan EMIs or tenure: What should borrowers do?

6 Purchase gold jewellery and gold artefacts with HUID number

From April 1, only hallmarked gold jewellery with a Hallmark Unique Identification (HUID) number shall be permitted to be sold at all jewellery stores in India. HUID number is a six-digit alphanumeric code. It will be given to every piece of jewellery at the time of hallmarking and will be unique for every piece of jewellery. It offers transparency and the buyer can get a true valuation of the gold purchased.

7 Axis Bank revises tariff structure for savings accounts

Effective April 1, Axis Bank has revised the tariff structure for savings and salary accounts. For instance, the bank has revised the average balance requirement criteria for the Prestige savings accounts. The average quarterly balance (AQB) of Rs 75,000 now becomes the average monthly balance (AMB).

Further, there is a revision of charges on non-maintenance of minimum average balance. Existing charges are NIL to Rs 600. From April onwards, it will be Rs 50 to Rs 600. The bank charges a premium for non-maintenance if the threshold is below 25 percent of the required balance. The bank has hiked the inward cheque return charges for non-financial reasons, from Rs 50 per transaction to Rs 150 per transaction.

Copyright © e-Eighteen.com Ltd. All rights reserved. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol.com is prohibited.

You are already a Moneycontrol Pro user.