Meet the firm behind our content. Visit their website to see how their services can help your business succeed.

Business intelligence is a critical component of the decision making process when considering where and how an investment into Asia should be made. Our team can help your business with its strategic direction.

Meet the firm behind our content. Visit their website to see how their services can help your business succeed.

The incorporation and structure of your investment define the early stages of your China expansion and impact your future success. A well-planned legal structure can help to make the difference.

Tax laws and regulations in China are continuously updated and refined. Our team of professionals is accustomed to navigating this fast-paced environment and can help your business remain compliant.

Managing personnel in China requires business to consider local, regional regulations and customs. Our services are designed to help foreign investors with compliance and best practices.

Meet the firm behind our content. Visit their website to see how their services can help your business succeed.

China Briefing is a premium source for news insights about doing business in China, contributed to by dozens of on-the-ground experts and investment professionals. It publishes business, industry and foreign direct investment news, as well as tax, legal, accounting, and HR regulatory updates.

Taxation affects almost all aspects of doing business in China. Given China’s distinctive legal system, that is widely different from its Western counterparts, a strong understanding of tax liabilities enables foreign investors to maximize the tax efficiency of their overseas investments while ensuring full compliance with the country’s tax laws and regulations.

Manager, Corporate Accounting Services

The tax system is still evolving at a rapid pace as authorities seek to improve transparency, compliance, and the ease of doing business in the country. Among others, China will accelerate the process of upgrading relevant tax regulations into law, improve the certainty of tax policies, enhance the authority of tax documents, and ensure the efficiency of tax administration.

In this guide, we discuss:

Tax

Standard Rate

Variations

Abbreviation

Corporate Income Tax

25%

10%, 15%, 20%, 25%

CIT

Value Added Tax

13%

6%,9%,13%

VAT

Withholding Tax

10%

0-15%

Stamp Tax

0.005%-0.1%

0.005%-0.1%

Individual Income Tax

3%-45%

3%-45%

IIT

Tax laws

Promulgation date

Implementation date

Stamp Tax Law

June 1, 2021

July 1, 2022

Deed Tax Law

August 11, 2020

September 1, 2021

Urban Maintenance and Construction Tax Law

August 11, 2020

September 1, 2021

Resources Tax Law

August 26, 2019

September 1, 2020

Vehicle and Vessel Tax (revised)

April 23, 2019

April 23, 2019

Corporate Income Tax Law (Revised)

December 29, 2018

December 29, 2018

Environment Protection Tax Law (Revised)

October 26, 2018

October 26, 2018

Individual Income Tax Law

August 31, 2019

January 1, 2019

Value Added Tax Law

Draft released

Consumption Tax Law

To be developed

Custom Duty Law

To be developed

Property Tax Law

To be developed

Land Appreciation Tax Law

To be developed

City and Town Land Use Tax

To be developed

The standard CIT rate in China is 25 percent.

This rate is applicable to resident enterprises and non-resident enterprises with income-generating establishments in China. All enterprises (except sole proprietorships and partnerships), including all organizations that generate income in China, are subject to CIT. The CIT resident enterprises and non-resident enterprises are subject to different tax obligations.

CIT is settled on an annual basis but is often paid quarterly, with adjustments either refunded or carried forward to the next year. The final calculation is based on a company’s year-end audit.

Corporate income tax (CIT) is one of the main taxes for businesses. The fundamental regulations on China’s corporate income tax are the CIT Law and its Implementation Guidelines.

General taxpayers pay VAT at a rate of 6-13%, while small scale taxpayers are subject to a uniform rate of 3%.

Value-added tax (VAT) is one of the major indirect taxes in China.

VAT taxpayers are categorized into general taxpayers and small-scale taxpayers based on their annual taxable sales amount. (The annual taxable sales here refers to the accumulated VAT taxable sales of the taxpayer during the continuous business period of no more than 12 months or four quarters). Taxpayers with annual taxable sales exceeding the annual sales ceiling set for small-scale taxpayers must apply for general taxpayer status.

The fundamental legal framework for VAT in China consists of the Interim Regulation of VAT promulgated by the State Council and its Implementation Guidelines released jointly by the Ministry of Finance and State Taxation Administration.

An individual’s comprehensive income is subject to 3% to 45% of progressive income tax rates.

The IIT Law divides IIT taxpayers into two categories:

The Individual Income Tax Law of China recognizes nine different categories of income, with several different deductions, tax rates, and exceptions applying to each of them – with foreigners working also eligible for certain fringe benefits.

It is the employer’s responsibility to accurately calculate and withhold individual income tax (IIT) on employment income, including wages and salaries, bonuses, stock options, and allowances, before paying a net amount to its employee.

The withholding CIT rate for non-tax resident enterprises is 20 percent, which is currently reduced to 10 percent.

Withholding tax (WHT) for CIT is levied on the income of foreign enterprises that do not have a physical establishment in China but provide services to China-based businesses. Any China-derived income arising from such a transaction between an overseas entity and a Chinese business is withheld by the China-based client, deducted from the gross income amount, and taxed by the Chinese tax authorities at a flat concessionary rate.

It is the responsibility of the China-based client to ensure compliance with the withholding tax policies. Not doing so may lead to penalties and the local tax bureau will take up repayment with the China-based client, and not the overseas entity.

Tax incentives are preferential tax policies offered by the government to incentivize or encourage a particular economic activity or to support disadvantaged business owners or individuals. From the investor’s perspective, tax incentives are legitimate tools for reasonable tax planning and cost savings. They are a useful indicator of market trends and government priorities.

There are multiple forms of tax incentives available to businesses, such as tax exemptions, tax reductions, lower tax rates, tax refunds or rebates, tax credits, etc.

Tax incentives are usually based on:

FIEs and domestic companies can generally apply for tax incentives equally, based on their qualifications, although local governments can offer certain tax incentives at their discretion to attract foreign investment.

China maintains a strict system of foreign exchange controls, meaning funds flowing into and out are tightly regulated.

There are several ways to repatriate profits. The most common is for the company’s China-based entity to pay dividends directly to its foreign parent company, which is subject to certain prerequisites.

Many multinational corporations also use intercompany payments, such as service fees or royalties, to remit cash from China. Other Chinese subsidiaries remit undistributed profits by extending a loan to a foreign related company with which it has an equity relationship.

China’s transfer pricing environment is more stringent than most other countries in the world. This mainly stems from how common non-compliance with the arm’s length principle has traditionally been in the country.

Transfer pricing concerns the prices charged between associated enterprises established in different tax jurisdictions for their intercompany transactions.

The relationship threshold for transfer pricing rules to apply between parties is low compared to other countries. All transactions between the HQ and its China-side entity should be conducted based on the arm’s length principle, as the two are related parties according to Chinese tax laws.

From a transfer pricing perspective, taxpayers have to be aware of their tax filing obligations. This consists of two parts:

Being well versed with various transfer pricing rules can ensure full compliance for MNCs while still guaranteeing that the transfer pricing process is effective and worthwhile. Besides, designing a transfer pricing system early in the business cycle helps to mitigate transfer pricing risk exposure and ensure that the enterprise’s adopted system is the most tax effective, consistent with its commercial objectives, and documented efficiently.

China implements a strict system of capital controls, limiting the inflow and outflow of foreign currency. This system distinguishes between transactions made under an enterprise’s current account and capital account and requires foreign investors to open separate bank accounts for the two.

The State Administration of Foreign Exchange (SAFE) and its local branches are the bureaus in charge.

Customs duties include import duties and export duties, which are computed either on an ad valorem basis or quantity basis.

Several factors, including preferential taxes under FTA’s, rates for Most-Favored Nations, lower rates for quota items, and provisional duty rates effect the amount of customs duty payable for import. Further, export duties are only imposed on a few resource products and semi-manufactured goods.

Import taxes and duties can be calculated after determining the duty paying value, tax and tariff rates of the goods.

China’s company law requires that companies prepare financial accounting reports at the end of each accounting year. These financial accounting reports should be audited by an accounting firm in accordance with the provisions of the law.

A financial audit is an objective examination and evaluation of the financial system and statements of an organization to make sure that the financial records give a true and fair view of the financial position of the company. Most companies conduct a yearly audit of their financial statements – which includes an examination of the income statement, balance sheet, cash flow statement, and statement of changes in equity, among others – as the first step of the annual compliance.

This also applies to all FIEs, irrespective of their corporate structure.

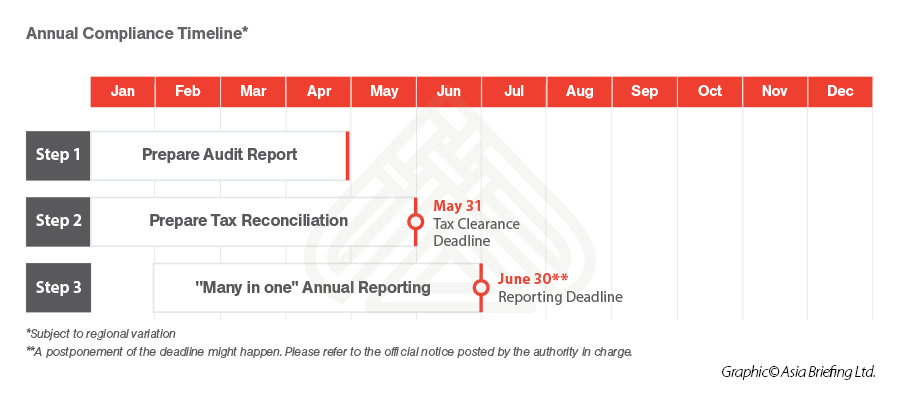

In advance of being able to distribute and repatriate profits, FIEs must complete annual compliance procedures, involving the following steps:

Businesses operating in China are required to follow the Chinese Accounting Standards (CAS), also known as the Chinese Generally Accepted Accounting Principles (GAAP).

The CAS framework is based on two standards:

The ASBE standards are significantly converged with the International Financial Reporting Standards (IFRS) and all listed companies in China must comply with the ASBEs for the preparation of their financial statements. Most foreign invested entities also generally follow the ASBEs.

The ASSBEs is a counterpart of the ASBEs, providing unified standards for small-size enterprises. The ASSBEs use the ASBEs as a reference but are more similar to tax laws in terms of their tax calculation methods, which simplify the process of making adjustments between accounting standards and tax rules. Small-scale enterprises can choose to adopt either the ASBEs or ASSBEs.

Manager, Corporate Accounting Services

Our experts can help! Contact us today to understand how we can help you lower your tax burden.

Explore This Service Contact personnel near you

Tax, Accounting, and Audit in China 2022/23 offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establis…

CHANGE SECTION

Hi there!

Let me show you how I can be of assistance.

I can help you find and connect with an advisor, get guidance, search resources, or share feedback about this site.

Please select what you’d like to do:

Hi there!

Our contact personel in Italy is:

Alberto Vettoretti

Alberto Vettoretti

Please select what you’d like to do:

Please share a few details about what guidance you seek. We can have a suitable advisor contact you within one business day.

Type keyword to begin searching…