ronstik

ronstik

Editor’s Note: This is the transcript version of the previously recorded show. Due to time and audio constraints, the transcription may not be perfect.

We encourage you to listen to the podcast embedded above or on the go via Apple Podcasts or Spotify.

This episode was recorded on March 28th, 2023.

Guest Bio: Zachary Marx is a Chartered Financial Analyst (CFA) that has consulted many institutions across all financial markets. Currently, he is a Sr. Quantitative Analyst at Seeking Alpha. Using quantamental methods, Zach searches for the perfect investing opportunities that are hiding in plain sight.

Follow Zachary Marx on Seeking Alpha

LICT Corp. – A Shareholder-Friendly Monopoly

Nelnet: Transitioning To A Best-In-Class Capital Allocator

Timestamps

(00:43) – Overall Market Opinion

(01:55) – Idea Generation Process

(03:02) – Lict Corporation Pitch

(11:31) – Nelnet, Inc Pitch

(18:16) – What should make potential shareholders excited about this stock?

(26:26) – Outro

Daniel Snyder: Zach, let’s go ahead and dive right on in. We got to start with this one. What is your general over market view right now?

Zachary Marx: I would say, overall, I think that the general sentiment, like around the market is, at least, from my perspective, like, pretty positive. But volatility has definitely been pretty heavily weighing on market participants and we see a big increase in put volumes over the past couple of weeks.

So I think people are hedging a lot, which can be an advantage to investors like us who don’t have to hedge or don’t have to think about next quarter’s returns, it can take a longer-term view. So from my perspective, honestly, I think everyone is worried about this SIVB situation and the other kind of ancillary banks that fell like Signature and Silvergate. But I’m taking a longer-term view, and I honestly don’t think that we’re going to see much more contagion from there. It seemed like those banks were kind of, for lack of better term, hedged inappropriately. So I’m taking a longer view and I’m definitely still buying stocks right now.

Daniel Snyder: Speaking of buying stocks, you’ve been publishing a lot of articles over here on Seeking Alpha. You sent over two names that we’re going to cover today in the episode. How did you go about finding these stocks?

Zachary Marx: Yeah. So I think from part of my investment process, I like to look at stocks that aren’t as widely followed just because I think there’s less competition. And if you kind of think of it as game theory, you want to know who the other side of the trade is, and it’s much tougher, or at least in my experience and from what I’ve seen, it’s much tougher to make money or find an undercovered stock or potentially undervalued stock when the entire rest of the Street is looking at, like there’s a 100 other analysts, or even just anecdotally on Seeking Alpha, if there’s been 20 articles written about a stock in the past month or two months, it might be more difficult to find kind of the undercover asset or something that maybe the rest of the Street missed just because they’re not looking. And that’s kind of what I think is going on with the two stocks that we’re going to discuss on Nelnet (NYSE:NNI) and OTCPK:LICT.

Daniel Snyder: But you just shared them out. Let’s start with LICT. What is LICT? What is this company I’ve never heard of it before, maybe some of the listeners haven’t either? What’s the thesis in the play here?

Zachary Marx: Yeah. So LICT is a rural telecommunications corporation, which maybe not everyone hears it. But to give kind of a quick thesis and what the tailwinds it has behind it is, is since the pandemic, we’ve seen a lot of people and I can say a lot of my friends as well, have spread out across the country and have kind of been migrating away from cities.

And even at Seeking Alpha and a lot of other corporations, we see more and more people working from home. And as a result, high-speed Internet is needed in much more rural areas given that these corporations have workers working from pretty remote areas now. And that’s what LICT does.

So LICT services rural areas across the country and tries to set up high-speed Internet in undercovered areas. And they kind of have a monopoly in these areas just because there is no competition. It’s – they’re the ones that made the capital investment in this – in these areas, and now they’re [roaring from here] [ph].

Daniel Snyder: So you’re saying they built out the infrastructure, kind of like a – I think most people think about, like, a Verizon, right? They build the infrastructure, and then they sell it to the customer, and they have a monopoly you say, how is that legal?

Zachary Marx: I guess, I don’t want to talk – I’m not a lawyer, so I’m not going to go into the legality of monopolies. But I think the answer is there hasn’t been the incentive for other players to come into this space, because it’s already served. And there aren’t so many – there isn’t a huge population of customers in kind of the mountains of New Mexico or in a rural part of Michigan or Western New Mexico or Northern Oregon.

So there isn’t a huge market there. Actually, now the government is even providing funding to LICT to expand in these areas to serve even more businesses because there’s still demand here. It just takes a while because the capital investment, it takes a long time in most cases to kind of get that money to come back to you. But LICT has done a great job of capitalizing on this.

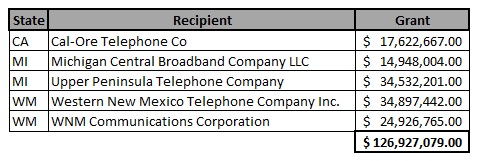

And we now see I think one of the things that the market has missed is LICT has now gotten a grant for almost a $127 million from a new recently passed act from the Biden administration, which is essentially a third or over a third of the company’s enterprise value because it has no debt now.

So – and actually, since that has been passed, the stock is down, which is really surprising in my opinion. But I think that is one of the things that I like to look for. So I kind of like to look for what is a factor? And as a quant, I do a lot of factor investing and think about what factors are going to outperform in the future and what factors are going to help my portfolio make money.

And one of the things I want to be exposed to, I think, is the government has passed a lot of these grants, whether it’s Inflation Reduction Act, which we’ll talk about with Nelnet, and this grant, which is the access to communities across rural America. And the Biden administration essentially provided $750 million or $759 million to bring high-speed Internet across rural America. And LICT is really able to capitalize on this because they’re essentially getting, for lack of better term, free money to help expand this – their services across America and they’re going to be able to choose given the rules of basically what I’ve seen on the – in the act.

They’re going to be able to choose where they can deploy this money first. And they’re going to deploy given the incredible management team, it’s Mario Gabelli and his kind of friends or who he selected to be in-charge of this corporation. They’re going to deploy it in wherever they think is the most accretive potential new business. So we’re going to see, in my opinion, a lot of new earnings and a lot of new earnings power coming from the spring.

Daniel Snyder: How long of a time horizon does an investor need for this particular story?

Zachary Marx: That’s a great question. So I think it seems like this money is going to be deployed over a number of years. So that’s one of the things I think where we can have an advantage is, again, we don’t have to worry about next quarter’s returns, which a lot of institutions do.

So I like to look and hold this for at least three to five years, especially because I think one of the risks I talk about is it’s pretty illiquid. Like, it only trades a couple of shares a day. And if you look at the bid-ask spread, it could be $500 apart, some days.

So from my perspective this is not – I’m trading in and out of this stock on a weekly or monthly or quarterly basis, it’s I’m holding this for a long time. And I want to be because I think the incentives are aligned with management, in that, Mario Gabelli owns the overwhelming majority of this company. And when you factor in his friends as well, they own the overwhelming majority of this company. And the company has been laser-focused on buying back shares.

In fact, a few years ago, someone asked if they would ever do a split to make this company more liquid? And Gabelli’s response was I would do a reverse split before I do a split. So he wants to keep this company kind of close to the chest and make sure that the shareholders who are in this are really aligned with the long-term success of the company and not worrying about next quarter.

Daniel Snyder: So that sounds like a Buffett play a little bit. So what is the risk here?

Zachary Marx: Yeah. So I would say, as I mentioned, one of the biggest risk is liquidity. So, the share price is pretty high. So if you need this money tomorrow or in a month or sooner rather than later, I would say this is not the stock for you to own. Additionally, there are no earnings calls and no kind of communication with management outside of their shareholder letter in the 10-K.

And lastly, it’s – company trades over the counter. It doesn’t trade on a major Exchange, which means that they don’t have the same reporting standards required by NYSE and NASDAQ. You’re kind of putting a lot of faith in management. But with that being said, I think that’s why the opportunity is here. It’s because we don’t have to fight against a lot of institutions who just can’t buy this because it doesn’t trade on a major exchange or it doesn’t have the liquidity necessary for their kind of mandates. So, yes, there are risks like any stock, but I think the risk reward here is, is very attractive if you’re willing to hold it for the long-term.

Daniel Snyder: So to play devil’s advocate, what would you say to people that are saying Starlink might be coming to solve this issue that they are trying to solve?

Zachary Marx: Yeah. So that – that’s a great question, one I’ve never thought of before, but I would say the – I would say there’s a couple of responses. So #1, I think we’re pretty far away from seeing even mass adoption of Starlink Internet. So I think that’s decades away, if I’m being honest.

And then the other thing I would say is Starlink is a business, so they’re going to go after the biggest markets first. They’re not going to target a town with potentially only 20,000 people on it, and we’re even seeing that now. The government is literally having to give money to LICT via these grants to put high-speed Internet in these towns with very – with a very low population. So I would be very surprised if Starlink is going after those towns with very, very small populations.

Daniel Snyder: All right. So let’s go ahead and leave it there on LICT Corporation, as ticker, LICT, and move on to this next one which you say the market is looking at all wrong. They have it in the financial services sector, but you’re saying that there’s an argument that it shouldn’t be there. So let’s go ahead and get into Nelnet, ticker symbol, NNI.

Zachary Marx: Yeah. So Nelnet is in the financial sector currently. But I think in the future, it might have a chance to move sectors. And the reason I say that is because its legacy business is in finance. It’s essentially a loan portfolio where they create a – where they collect a spread off the interest. But it’s now a conglomerate. And essentially, Nelnet is using the proceeds from their loan portfolio to fund this diversified conglomerate of companies. And they’re making new investments every single day, which is just further diversifying their revenue streams.

Daniel Snyder: What kind of investments are we talking about here?

Zachary Marx: They have five different operating segments right now. So we’ll start with the first one, which is their legacy finance business, which is a loan portfolio of student loans, which are guaranteed by the government. So the government has now taken public student loans in-house. And since 2010, there have been no new loans issued.

So right now this is kind of a melting ice cube. It’s – eventually, this loan portfolio will be paid back. But right now, they’re still collecting a nice interest income. And I think this year will be the most they collect. But they’re still going to collect well over a $100 million for the next couple of years, even $200 million next year, I think.

The second business is their loan servicing division, which is Nelnet Diversified Services, where they essentially have a contract with the government to service these loans. So even though the government is issuing these new loans now, but they’re servicing them. So if you get a loan from the government, you might be familiar with Nelnet because you’re paying that loan through the Nelnet servicing portal.

The next one they have is a new one, which is actually as of March 2020, which is called Nelnet Bank, which is a new bank, and they’re actually the first new industrial bank launched since 2008. Now, Square, I think, followed up right after them. They’re sourcing new loans via this bank, doing private student loans and then also kind of vertically integrating by having their Nelnet Diversified Services to service those student loans as well, and then also going after some consumer loans as well.

So we’ll talk about this bank more, and I kind of want to go through some of these more in-depth, but we’ll keep going. So Nelnet Business Services, which is really, really interesting. And I think this is one of the things that is kind of being undervalued or overlooked. So this is an education tech business.

They essentially are the back-end software and administrative systems for new schools and charter schools and private schools that are coming to vision or kind of newly starting up. They are essentially a SaaS platform for education as we’ll go into, they’re growing really, really rapidly. And this asset-light business is, I think, being overlooked because this company is essentially almost trading at book value. Even though they have a very, very asset-light business, that’s spitting out over a $100 million in operating income a year.

Then they also have Nelnet Communication Services, which is similar to LICT. They’re doing fiber optic network in kind of also some underserved markets like Nebraska and Colorado, although they’re not benefiting from the grant we talked about in LICT’s case, but it did just sell off a massive portion of ALLO. They sold off about, I think, 52%, and realized a nice gain on their investment and now have preferred shares and are a minority owner of the company.

I think they own 45% now, but they’re still going to collect dividends. And it seems like this is a very, very growing business. I think we’re still going to see a lot more return from this company as it goes forward.

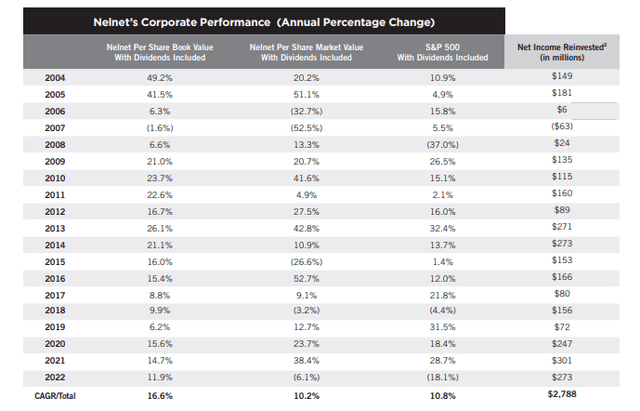

Lastly, the thing I would say I’m most excited about is Nelnet Renewable Energy. And this is kind of where I’ve got really excited about this company because Nelnet essentially had a problem, in that their core legacy business was rolling off or melting away. And they needed to find something where they can deploy this massive capital that their loan book is spitting out and still achieve the high hurdle rate of, I think, 16% compounded book value that they’ve done for the past at least 10 years.

So this renewable energy business, I think, is the answer to that. And we’ll talk about how they’ve kind of vertically integrated across here and have real, real competitive advantage now. There is just so much opportunity with this company, and the management team just has an incredible track record of compounding book value over time and being successful in their businesses.

And we can talk about their venture portfolio also – which I also forgot to mention as well. They have a 20% stake in a unicorn called Hudl, which if you’ve ever heard of it, Hudl has a monopoly in sports analytics. They have essentially set up cameras across high schools in the U.S. and work with teams to do analysis in high school sports.

So now if a scout wants to see Daniel Snyder’s high school highlight video, they can just seamlessly upload it via Hudl and send it to a scout. And then teams can review each other’s previous games to prepare for future matches. And they also are doing this in not just high schools, but across several different professional sports. It’s being used in the MLS and a few other professional sports as well. So there’s just really an incredible amount of things to be excited about by this business. And management’s team’s track record of investing is just unbelievable.

Daniel Snyder: So that’s a lot of different business segments that you just dove into. But in regards to the financials, what should shareholders or potential shareholders start getting really excited about?

Zachary Marx: Great question. So obviously, we just talked about a lot of different business segments they have. So they break out a bunch of them. So we’ll talk about right now where is kind of the cash that’s coming in the door coming from. So it’s honestly a pretty equal split between loan servicing asset generation, which is the credit portfolio and then the ed tech right now.

So in the last, I guess, annual report, we saw loan servicing brought in $573 million, ed tech brought in $418 million, and then asset generation brought in $509 million. So it’s pretty diversified. And the other thing I would say about this company is they’re pretty opaque. Management has been not as transparent as one would like, which is, in my opinion, a good thing because it’s really – they keep things close to the chest and do very, very conservative accounting, like, some of the most conservative accounting I’ve ever seen in that, they hold a lot of their venture portfolio at cost.

In their latest letter, they even discussed how Nelnet recognized $45 million worth of gains from the sale of real estate in this past year even though their current portfolio now has a carrying value of $80 million. And management talked about if they were to sell that real estate, they would likely realize pretty massive gain on that $80 million.

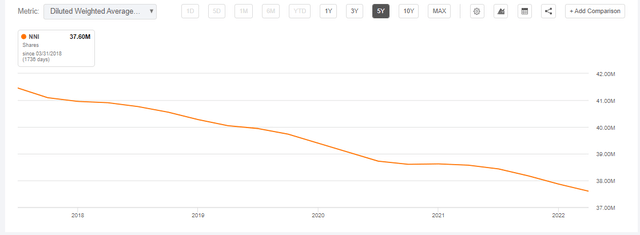

So everything they do is kind of it feels like trying to stay under the radar, which is because I think the Chairman owns about 40% of this company or 42% of this company, and the CEO owns a decent chunk of this company as well. So it feels like they’re trying to keep the share price low, so that they can continue buying back shares. And if we talk about rewarding shareholders, if you look at a chart of their shares, I mean, it just looks like it’s going straight down like a [casino] (ph).

And additionally, they’re paying out dividends. Although I think that the previous or that one of the two Co-Founders, so not the current Chairman, Michael Dunlap, another guy named, I believe, Scott Butterfield. He, I think, was more in favor of the dividend, so I’m not sure if we’ll see them continue to increase it as rapidly. But they do such a good job compounding their investments and really feel like they hit a home run almost with every single investment. It’s kind of scary that I would almost rather than keep the money they give it back to me just because of how well they’ve done with their investment portfolio.

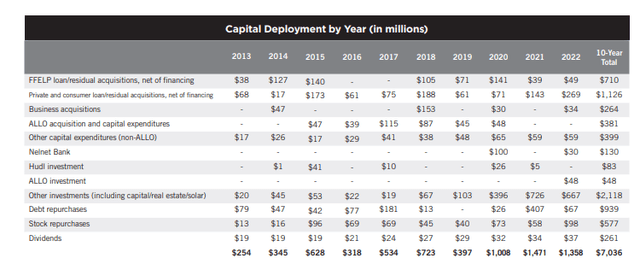

And I think one of the charts at the bottom of my article is just this incredibly impressive chart of their corporate performance, where they talk about how they’ve compounded their book value at over 16.5% since 2004, which is very, very difficult to find. And they also show you how they deploy their capital since then.

So dividend, stock repurchases, debt repurchases, and then all of the different investments they’ve made. They talk about how they’re going to continue deploying this capital in their renewable solar business. So just to give a little bit more color on what that is. They’re essentially setting up community solar farms in kind of rural areas, I guess, like, upstate New York and Colorado, and they’re setting up a subscription utility.

So instead of having to have solar panels placed on the roof of your house, you’ll just be plugged into their solar farm, pay a subscription and have whatever that solar farm production is reduced from your utility bill. They’ve found a way to deploy this incredible amount of capital into a project that is also giving them government benefits via solar tax equity credits. And on top of that, they are going to be able to capitalize on these solar tax equity credits.

So many investors, which if you Google Solar Tax Equity credits, don’t have either the capital or the businesses or the tax liability to make good use of these credits. But Nelnet has so many other business lines and they have such a high tax liability that it’s going to meaningfully affect their tax liability. And I think we’ll see their tax expense decline while they’re building this new business for what I think is going to be a significantly discounted price.

And also, just kind of furthering their advantage with this or furthering how they can continue seeing positive investment and positive returns from this, they just acquired a solar construction company. And I think that’s a massive competitive advantage from them because now they’re going to control the capital investment and the construction.

I think this is just going to be an incredible new segment that we’re going to see pop up as a segment in their income statement, next – income statement and cash flow statement in the next couple of years.

Daniel Snyder: So, Zach, I want to go back a second because as you’re mentioning all the different companies, venture arms and everything else that this company has, we were talking about Nelnet Bank and the infrastructure bank. And a lot of people aren’t really in favor of banks right now. So what is the deeper dive that you wanted to get to about this bank?

Zachary Marx: Obviously, right now, there’s a lot of concern with banks and especially banks that are growing very quickly, and Nelnet Bank is growing very quickly. But what management has showed us over the past several years is they have an amazing track record of taking very small losses on their loan books.

So I think, they – they’re kind of debt experts for lack of a better term. They had, since the birth of Nelnet, they’ve been involved in debt, #1. And then #2 is they are going to continue to grow, but they’re – have said in their shareholder letter they’re maintaining proper levels of capital and liquidity. They also are trying to focus, I think, on government-backed products.

So their whole loan book is obviously backed by government. But I think Nelnet Bank is going to continue focusing on products that either have some government backing, whether it’s solar loans for that type of business or the consumer loans while they’re not government backed, I think, again, this is where we’re going to have to put some sort of faith in management. They’re not growing too quickly and they can manage a loan book, but just to give some perspective on why we have faith in management.

So very dissimilarly to what we’ve seen with those regional banks that have been hurt by not managing their interest rate risk appropriately Nelnet’s management actually put into place a bunch of pay fixed receive floating swaps. So what that means is they put hedges into place, so that when interest rates rose, they would actually be totally fine and actually realize a profit, $5 million, I think, they’ve said to earnings for just a hedge, which is just pretty amazing, given that they have such a massive loan book that they need to hedge for. So I think management is going to be pretty conservative, put in place the proper hedges where necessary, and we’ll see the bank continue to grow, not at a pace too quickly.

Daniel Snyder: Amazing. Thank you so much, Zach, for the deep dive into Nelnet and LICT today on the podcast. Everyone listening, if you want to check out more of Zach’s work, you can head over to Seeking Alpha, go to the search bar and type in Zachary Marx, that’s M-A-R-X. We really hope you’ve got something out of this episode. And if you have any questions that you want to ask Zach about these companies, go over to the show notes page, leave a comment down at the bottom. You can also see all of the data tables, graphs, and everything referenced in this episode as well.

And lastly, just a reminder, anything you hear on this podcast should not be considered investment advice at times myself or the guest my own positions in the securities mentioned, but this is for entertainment purposes only. And you should seek advice from a licensed professional before investing. And if you’ve listened all the way to the end, you’re the real MVP. Thank you listener, and we’ll see you in next episode.

We encourage you to listen to the podcast embedded above or on the go via Apple Podcasts or Spotify.

Follow Zachary Marx on Seeking Alpha

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by