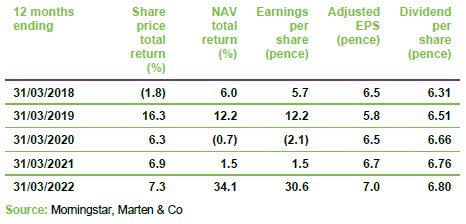

Investment companies | Annual overview | 31 March 2023

In common with its peers, JLEN Environmental Assets (JLEN) experienced an eventful but fruitful 2022. Volatile power prices, rampant inflation, rising interest rates and new taxes all appeared to buffet the renewables sector but generally acted as a tailwind for NAV growth. Some of these issues look likely to continue to affect the sector in 2023.

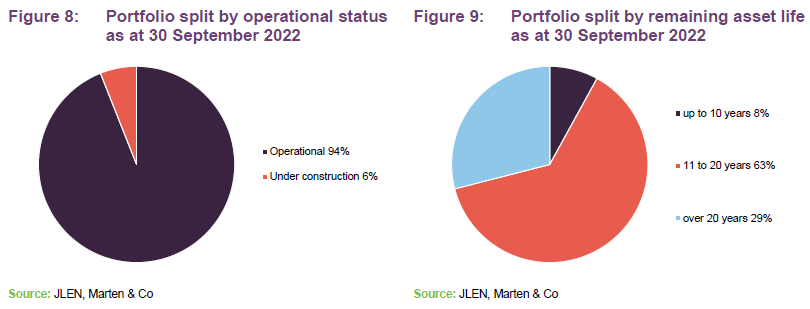

JLEN’s managers can have little influence on these big macroeconomic factors but they can try, through their investment activity, to lay the foundations for future NAV uplifts. At the end of its last accounting year, JLEN had 6% of its portfolio in assets under construction or development, and a sizeable pipeline of new opportunities. As they reach maturity, these projects can act as an engine for capital growth.

JLEN aims to provide its shareholders with a sustainable, progressive dividend, paid quarterly, and to preserve the capital value of its portfolio. It invests in a diversified portfolio of environmental infrastructure projects generating predictable, wholly or partially index-linked cash flows. Investment in these assets is underpinned by a global commitment to support the transition to a low carbon economy and mitigate the effects of climate change.

Projects that use natural or waste resources or support more environmentally friendly approaches to economic activity.

JLEN invests in infrastructure projects that use natural or waste resources or support more environmentally-friendly approaches to economic activity, support the transition to a low carbon economy or which mitigate the effects of climate change.

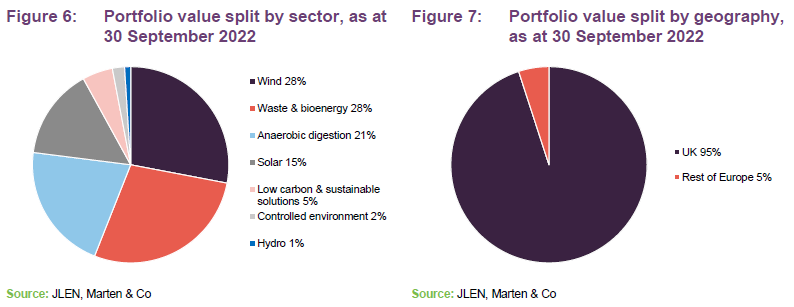

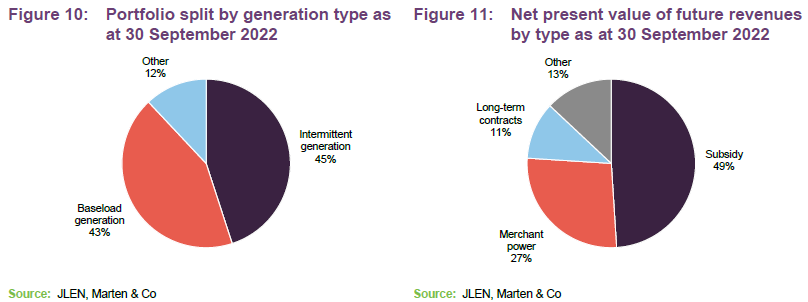

JLEN’s assets are broadly categorised as intermittent renewable energy generation, baseload renewable energy generation and non-energy generating assets that have environmental benefits. Intermittent energy generation investments include wind, solar and hydropower. Baseload renewable energy generation investments include biomass technologies, anaerobic digestion and bioenergy generated from waste. Non-energy generating projects include wastewater, waste processing, low carbon transport, battery storage, hydrogen and sustainable solutions for food production like agri- and aquaculture projects.

JLEN aims to build a portfolio that is diversified both geographically and by type of asset. This emphasis on diversification should reduce the dependency on a single market or set of climatic conditions and help differentiate JLEN from the majority of its peers, which tend to specialise in solar or wind.

Reflecting its objective of delivering sustainable, progressive dividends and preserving its capital, JLEN does not invest in new or experimental technology.

A substantial proportion of its revenues is derived from long-term government subsidies.

JLEN’s AIFM is Foresight Group LLP (Foresight). Foresight is one of the best-resourced investors in renewable infrastructure assets, with £12.3bn of AUM as at 31 December 2022. This includes Foresight Solar Fund, which sits in JLEN’s listed peer group. Foresight has a highly-experienced and well-resourced global infrastructure team with over 100 infrastructure professionals managing around 3.1GW of energy infrastructure. It is a global business, with 13 offices in seven countries. The co-lead managers to JLEN are Chris Tanner, Chris Holmes and Edward Mountney (see page 23).

Our last note was published six months ago. In it, we identified a number of factors that appeared to be influencing JLEN’s chosen sectors – power prices, inflation, taxation, energy market reform, and rising discount rates. We revisit these below, beginning with discount rates, which may be weighing on the London-listed renewable energy sector.

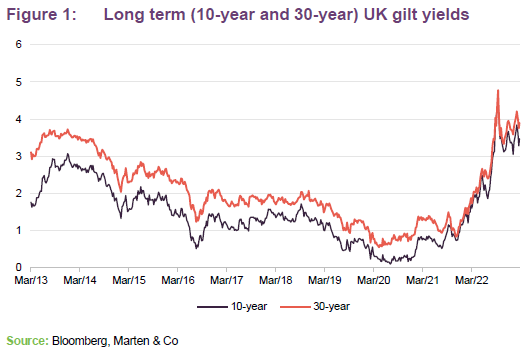

As Figure 1 illustrates, there has been a steep rise in government borrowing costs since the beginning of 2021. This was accelerated by the fallout from the ‘mini budget’ of September 2022, but gilt yields have not fallen back much since.

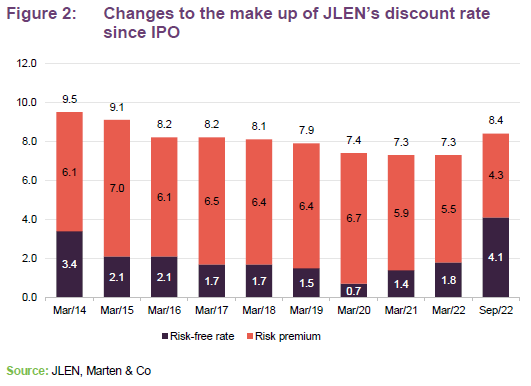

The discount rates that are used in the discounted cash flow calculations that inform the NAVs of many alternative assets funds, including those in the renewable energy sector, can be broken down into the risk-free rate – derived from the yield on a government bond with equivalent duration – plus a risk premium. That might suggest that a steep rise in discount rates is warranted. However, the discount rates are also informed by the prices that assets change hands at in the secondary market. These are not much affected, perhaps suggesting that the risk premium has actually been falling.

At 30 September 2022, the directors decided that a 0.75% increase in the fund’s weighted average discount rate was appropriate (increasing it to 8.4%) and that was factored into the NAV at the time. The decision took £36.1m or about 4.5% off the NAV.

Figure 2 shows how the make up of JLEN’s discount rate has changed since its IPO. Various other factors influence this including the composition of the portfolio. Investors’ risk appetite for some sectors has increased over time as they have become more familiar with these assets, and this may also have an effect. Nevertheless, if investors feel that discount rates are likely to trend higher, as an indication JLEN estimates that, based on the portfolio at end-September 2022, a 0.5% increase in the discount rate would deduct £20.1m or 3.1p from its NAV.

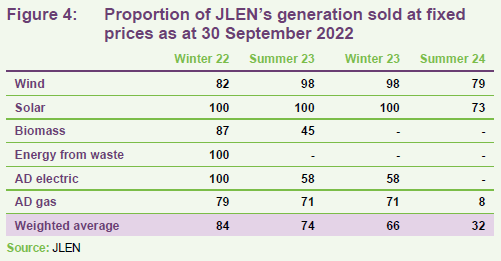

UK power prices have been falling from the extreme peak of summer 2022, as have gas prices. However, they are still above pre-COVID levels. JLEN has been seeking to lock in these higher prices for longer as is shown in Figure 4.

The numbers in Figure 4 are of course almost six months out of date but may illustrate the approach the JLEN takes to de-risking its exposure to volatile market prices. Based on the portfolio at end September 2022, the directors estimate that a 10% fall in power prices over the remaining life of JLEN’s assets would have taken off £43.6m or 6.7p from the NAV and a 10% increase would have added £44.1m or 6.8p to the NAV. To give an illustration of how the portfolio interacts with the electricity generator levy (see below), the directors estimate that a 5 year +10% uplift in unhedged power and gas prices would increase NAV by 2.1 pence per share.

The UK’s electricity generator levy was announced on 17 November 2022. The levy applies from 1 January 2023 and runs until 31 March 2028. Non-fossil fuel generators producing electricity from nuclear, renewable, biomass, and energy from waste sources, are required to pay a tax of 45% of their excess revenue from sales of power generated in the UK above a level of £75/MWh from 2023 to April 2024, and thereafter adjusted each year in line with the change in inflation (as measured by CPI) on a calendar-year basis.

The definition of revenue includes the impact of any hedging or forward sales of power, and excludes income from FiTs, the sale of ROCs, and capacity market payments. The levy does not apply to revenues derived from battery storage, and sites that incorporate both renewable energy generation and battery storage will have to separate power generated from power re-exported to the grid for the purposes of calculating the levy.

JLEN had made provision for the likely effects of the levy in its end September interim results and adjusted its September NAV to reflect the announcement on

17 November 2022 just ahead of publication.

The managers note that 43% of JLEN’s end September assets fell completely outside of the levy. They comment that this is a strength of having a diversified portfolio that has a combination of assets that generate electricity (and fall in the scope of the levy) but also assets that generate gas (the anaerobic digestion plants), and also some assets that don’t generate energy at all (for example, batteries, CNG refuelling stations, and the controlled environment assets).

A high degree of government backed subsidised revenues and long term contracts across the portfolio means that, on the managers’ estimate, around 60% of JLEN’s forecasted revenues on a net present value basis are linked to inflation as measured by the RPI.

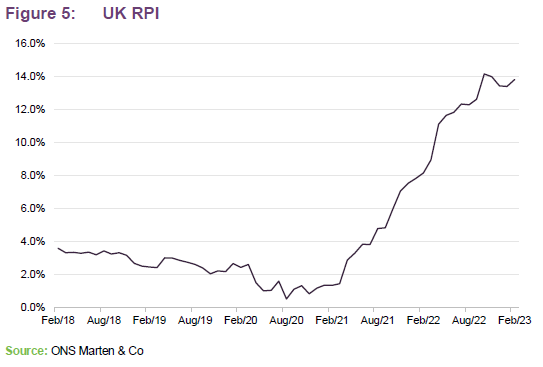

UK inflation was expected to slow in February 2023, but that was not the case. JLEN’s sensitivity to changes in the inflation rate is said to be about +£18.2m or 2.8p on the NAV for every 0.5% increase in the forecast inflation rate. At the end of September 2022, JLEN was expecting an inflation rate of 10.4% in 2022, 4.6% in 2023, 3% for 2024-2030, and 2.25% thereafter. With RPI running at 13.4% at the end of December 2022 and 13.8% at the end of February, there could be substantial further upside to come from this factor.

REMA (the review of electricity market arrangements) that we discussed in our last note, is still progressing. The Department of Energy Security and Net Zero published a summary of responses to the consultation on 7 March 2023. While some approaches were ruled out, it is still far too early to draw any conclusions about the likely route forward.

The JLEN team recognises that there could be an effect on the basis on which its UK electricity-generating assets and battery storage assets receive their revenues. However, they feel that JLEN’s diversified portfolio could put it in a strong position relative to its peers.

Foresight selects projects for the portfolio based on its assessment of each project’s risk and reward profile that fit within its defined investment policy. The group operates within a limited set of investment restrictions. New assets predominantly come from investments in the secondary market acquired from third parties.

The AIFM aims to maintain the balanced and diverse nature of the portfolio. Its approach is a cautious one. Although JLEN can invest across all OECD countries, to date investments have predominantly focused on the UK, with a small but growing exposure to European renewables. The managers say that they prefer to concentrate on countries and regulatory/subsidy regimes that they know well or where they have relationships with established partners.

Deals can be introduced by the wider Foresight team.

The managers say that they have built up good working relationships with project developers. Some opportunities are brought to the managers for appraisal by specialist consultancy firms operating in the area. Deals may also be introduced by the wider Foresight team.

Prices are negotiated at arm’s length and reflect the managers’ assessment of the potential risks and rewards from each project. This includes a review of the project’s capital structure.

Environmental criteria are embedded in the structure of JLEN’s investment and portfolio management activities.

With Foresight, JLEN considers environmental criteria against the UN Sustainable Development Goals during due diligence of a potential acquisition and thereafter the ongoing monitoring of its assets.

In order to inform its environmental objective, JLEN considers the following environmental KPIs and associated measurements:

The day-to-day facilities management, operations and maintenance of the projects is contracted to third parties.

The day-to-day facilities management, operations and maintenance of JLEN’s projects are contracted to third parties, and part of the managers’ role is overseeing these arrangements, including approving payments.

The managers seek to identify opportunities for efficiency enhancements and capacity increases.

The managers also aim to optimise the financial structures of the project SPVs.

JLEN will usually hold its assets for the long term, but the company will sell assets when the managers feel the sale price justifies it or when there are other valid reasons for doing so. As an example, JLEN sold its French wind portfolio early in 2022 and since redeployed the proceeds into new investments.

When they invest in assets in currencies other than sterling, the managers may choose to hedge the currency exposure back to sterling. The managers may also hedge interest rate risk, inflation risk, power, and commodity prices. All hedging is entirely at the board’s discretion.

There are obvious environmental benefits that derive from JLEN’s investment strategy, and the company is an Article 9 fund under SFDR. It has also been awarded the London Stock Exchange’s Green Economy Mark. In our March 2022 note (see page 13 of that note) we showed how JLEN’s activities map onto the UN SDGs.

In terms of measurable outcomes, over the course of the six months ended

30 September 2022, the portfolio generated 655GWh of renewable energy (sufficient to meet the electricity demand of about 125,000 households). It treated more than 14.5bn litres of wastewater and its actions resulted in more than 351,500 tonnes of waste being diverted from landfill, with 69,500 tonnes of waste recycled.

Foresight is a signatory of the United Nations’ Principles for Responsible Investment (UNPRI) and as we noted above ESG analysis is built into JLEN’s investment process. It is also incorporated into the ongoing monitoring programme for JLEN’s portfolio.

JLEN devoted 19 pages of its annual report to TCFD last year (49–67) and TCFD is now a standing agenda point on the board-level ESG sub-committee. Foresight has been working with an external consultant to assess the portfolio’s scope 3 GHG emissions.

The following charts show the shape of JLEN’s portfolio as at 30 September 2022, and therefore exclude the Thierbach green hydrogen project discussed on page 14. The 5% outside the UK is accounted for by JLEN’s Italian and Norwegian investments.

As at 30 September 2022, the weighted average remaining asset life of the portfolio was 16.9 years.

At 6%, JLEN’s construction exposure is materially higher than it was a year ago. These projects offer the potential for NAV uplifts as the projects become operational and the discount rate applied to them can be reduced as they become de-risked.

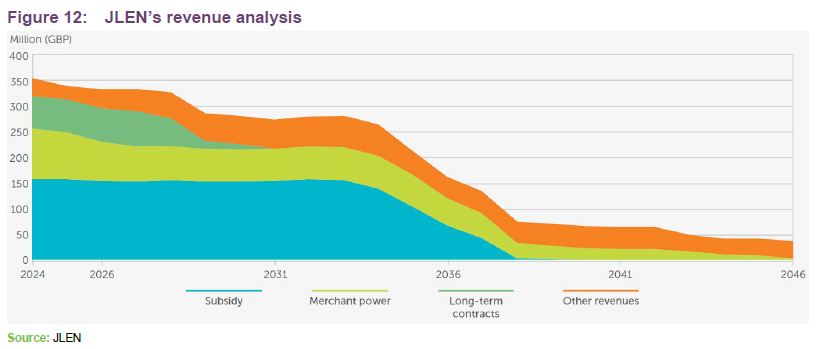

Whilst subsidies make up almost half of JLEN’s future revenues, they are time-limited. The chart in Figure 12 is taken from JLEN’s interim report and shows how the make-up of its future revenues between 2024 and 2046 changes over the life of the projects in its portfolio.

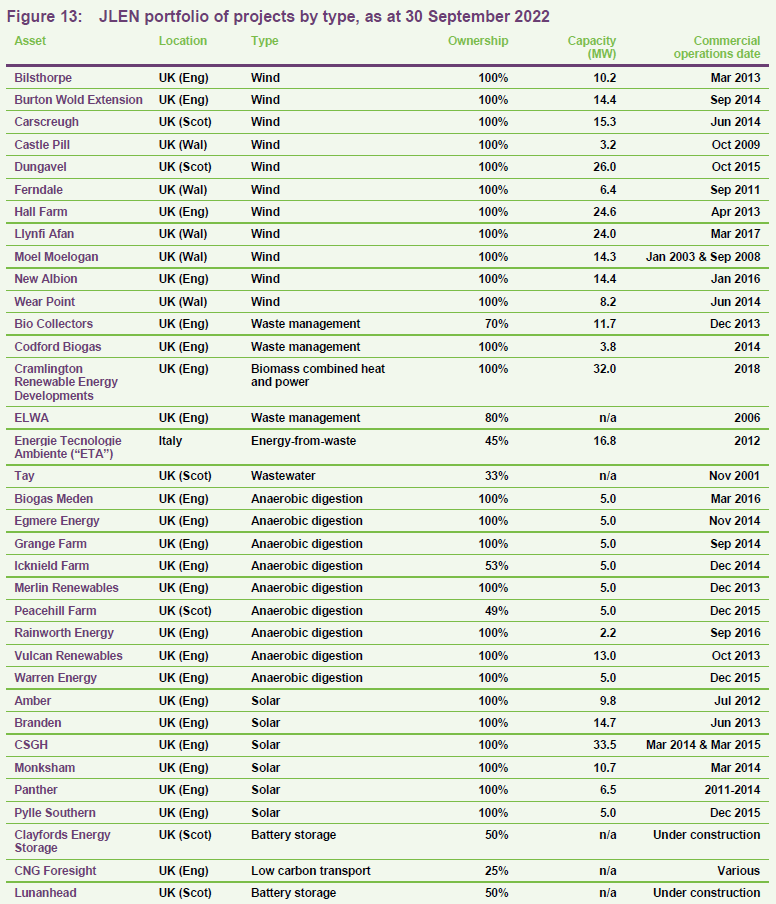

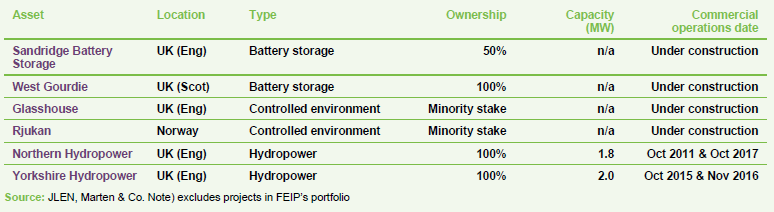

As at 30 September 2022, JLEN’s portfolio comprised interests in 41 project vehicles. These are listed in Figure 13.

JLEN has a pipeline of potential investments including in the area of controlled environments and hydrogen. The managers are conscious that the market environment is challenging at present for raising additional equity and are factoring that into their decision-making.

It may be opportune to recycle capital from more mature assets within the portfolio, as they already have done with the fund’s French windfarm investments.

In our last note, we discussed JLEN’s two new controlled-environment projects – the Rjukan aquaculture plant and the glasshouse that is co-located with a JLEN anaerobic digestion plant. Since then, the Norwegian government has proposed a tax on sea-based fish farms. Whereas land-based facilities, such as JLEN’s recirculating aquaculture facility, would remain unaffected by the new tax; improving the relative economics of land-based investments. The managers say that the co-located glasshouse project is progressing well. It may be possible to develop similar projects alongside other AD plants, but there is a land-availability constraint to this.

Just after we published our last note, JLEN announced that it was spending up to £16.4m to buy a 50% equity stake in Gigabox No 4 Limited, which holds the development rights to construct a 49.9MW lithium-ion battery energy storage plant based in Lunanhead, Angus, Scotland. JLEN’s partner in the deal was Foresight Solar Fund.

The announcement said that the project is fully consented and construction-ready and is expected to start commercial operations in early 2024. Initially, the project’s grid connection will be limited to 45MW, increasing to the full 49.9MW capacity by early 2025.

The existing market for hydrogen is estimated to be worth $175bn annually.

Hydrogen is used in many industrial processes including oil refining, the production of ammonia for fertiliser, chemicals, artificial fibres, glass, electronics and metallurgy. This existing market for hydrogen is estimated to be worth $175bn annually. Almost all of this is grey hydrogen, which is produced by steam methane reforming (SMR) of natural gas and generates about 830m tonnes a year of greenhouse gases. Governments recognise the urgent need to decarbonise this sector. Additionally, in Europe in particular, the war in Ukraine created a new imperative to find alternatives to Russian natural gas.

Blue hydrogen – hydrogen produced from SMR but with associated carbon capture and storage – is unlikely to provide a long-term or complete solution. However, green hydrogen – produced from the electrolysis of water using renewable energy – is increasingly cost-competitive and produces no greenhouse gases.

In aggregate, the potential market for green hydrogen is estimated to be $2trn.

Green hydrogen offers a route to decarbonising a wide range of industries, particularly those that are heavy consumers of energy. It can also fuel heavy transport – HGVs and ships, for example. The diversion of excess production of renewable energy at times of peak supply (when intraday power prices are exceptionally cheap) into hydrogen generation also offers another form of energy storage that can be held indefinitely (unlike traditional battery storage) and used to fuel peaking power plants. In aggregate, the annual potential market for green hydrogen is estimated to be $2trn.

Significant subsidies for green hydrogen.

Globally, governments seem to have accepted the need to accelerate the transition to green hydrogen and are providing significant support to this. In the US, the Inflation Reduction Act contained $9.5bn of funding for hydrogen to subsidise production tax credits of up to $3 per kilogramme. In Europe, the EU strategy on hydrogen was adopted in 2020. In May 2022, the EU published its REPowerEU plan, which is designed to find alternatives to Russian fossil fuels. Its ambition is to produce 10m tonnes and import 10m tonnes of renewable hydrogen in the EU by 2030.

Projects are being built.

While the operational base of green hydrogen is just 0.8GW today, 6.0GW is under development and 1.2TW of projects are proposed.

For the next few years, there may be more than enough demand from customers looking to switch away from grey hydrogen to justify the construction of these new plants. However, the alternative use cases are already being developed. For example, in the UK, National Gas’s Future Grid project is testing the effect of blending hydrogen with natural gas in the existing transmission network. Snam in Italy has already tested a 10% blend and in Germany, the town of Oehringen in the southwest of the country is trialling a 30% blend.

On 26 January 2023, JLEN, announced that it was making first use of its 5% development allowance with its first investment into the green hydrogen sector. It has acquired a 33% equity stake in Foresight Hydrogen Holdco GmbH. JLEN has some additional underlying exposure through its investment in Foresight Energy Infrastructure Partners, which also bought a 33% stake, The balance is owned by Foresight ITS.

Foresight Hydrogen Holdco owns a 75% stake in HH2E Werk Thierbach GmbH, an SPV which, in turn, owns 100% of the development rights to HH2E’s Thierbach green hydrogen project, a large green hydrogen production plant near Borna in Germany.

Thierbach is being developed by HH2E, a German specialist in developing projects to decarbonise industry, using green hydrogen. Foresight Hydrogen Holdco also holds a 7.6% stake in HH2E.

The design of HH2E’s plants uses alkaline electrolysis powered by green energy (based on the procurement of green energy supplied through the national grid rather than a direct supply). The plant incorporates battery storage, allowing it to deliver constant hydrogen production with a variable power supply – meaning that it can target buying power at intraday low prices.

Initially, the plant will have a 100MW electrolyser capable of producing around 6,000 tonnes (over 200GWh) of green hydrogen per year. The plant is designed to be scalable to 1GW by 2030.

Thierbach is in Saxony and its prospective customers are said to include large-scale energy and industrial consumers such as the chemical industry and commercial air and road transport operators.

The JLEN team says that Thierbach is very similar to a traditional infrastructure investment – a collection of long-term contracts covering both input costs and offtake agreements, most likely on a take or pay arrangement.

Thierbach is expected to be just the start; Foresight Hydrogen Holdco also has priority funding rights over further projects. In addition, each site could potentially expand to several times its size.

JLEN’s initial investment is €5.7m, part of a c.€13m capital injection into the project to bring Thierbach to a construction-ready stage (funding front-end engineering and design, and the purchase of the land and key equipment). The balance of the project funding could come either all from the equity backers (perhaps with a later refinancing) or it may be that banks are ready to lend to the project.

The JLEN team says that Thierbach offers an attractive return profile, including the prospect of NAV uplifts as the project progresses through to operations. Additionally, the discount rates on these projects should fall as investors become more familiar with these projects. The team believes that JLEN’s priority rights may prove valuable.

JLEN’s NAV returns over the past 12 months have been good. The drivers of this are explored over the next few pages. The share price has not kept pace with the NAV, as is discussed on page 21.

UK wind assets continue to be affected by a lower than budgeted wind resource, this is not unique to JLEN. In its case, generation for the six months ended

30 September 2022 was 13% below target. In addition, a planned grid outage affected output from Llynfi.

By contrast, solar generation was above budget, perhaps demonstrating the benefits of pairing wind and solar in a portfolio – generally low wind resource is associated with higher solar resource and vice versa.

Output from the AD portfolio over H1 FY23 was ahead of budget, once again. The manager notes that the 2022 UK maize harvest (used as a feedstock for AD plants) was impacted by high gas prices affecting the cost of fertiliser and a lack of rainfall over the summer of 2022, which reduced crop yields. The manager has responded by securing additional sources of feedstock for next year.

Technical issues at the Bio Collectors food waste plant and ETA energy-from-waste plant detracted from the overall performance. The manager has been working with the asset operators to remedy these issues.

Cramlington’s unplanned shutdown was discussed in the half-year report. A similar plant developed a fault with a rotor on the turbine and operations were suspended while the manufacturer investigated whether Cramlington was similarly affected. It turned out that the part needed to be replaced, but this remedial work has since been completed and the plant is back up and running. The manager took advantage of the shutdown to accelerate other planned maintenance.

The manager says that JLEN’s battery storage projects secured some capacity market revenues in the last auction, but these are not material to the company’s revenue. JLEN’s first battery project, West Gourdie, is now energised and going through the commissioning process. This may have a positive impact on the end-March NAV as this project becomes de-risked.

The hydro portfolio was severely affected by low rainfall over the six months ended 30 September 2022, generation was 48.7% below target. However, the effect on JLEN’s overall result was not material as hydro represents just 1% of the portfolio.

The end December NAV was £816.7m or 123.5p per share. This was a little lower than the 124.4p recorded for the end of September (after adjusting for the Electricity Generator Levy).

The main drivers of this return were said to be:

The NAV figure at end September 2022 was 125.4p, but this was subsequently adjusted to 124.4p to reflect the impact of the UK government’s Electricity Generator Levy, announced in the Autumn Statement in November 2022. This figure was up on the end June figure of 123.1p

Apart from the levy, the main influences on the Q3 NAV were forecast power prices, changes to economic assumptions (including inflation), and an increase in weighted average discount rates (by 0.75% as discussed on page 4). We have not broken these down in terms of pence per share as JLEN only reported the changes over the six months ended 30 September, rather than the three-month period ending on the same date.

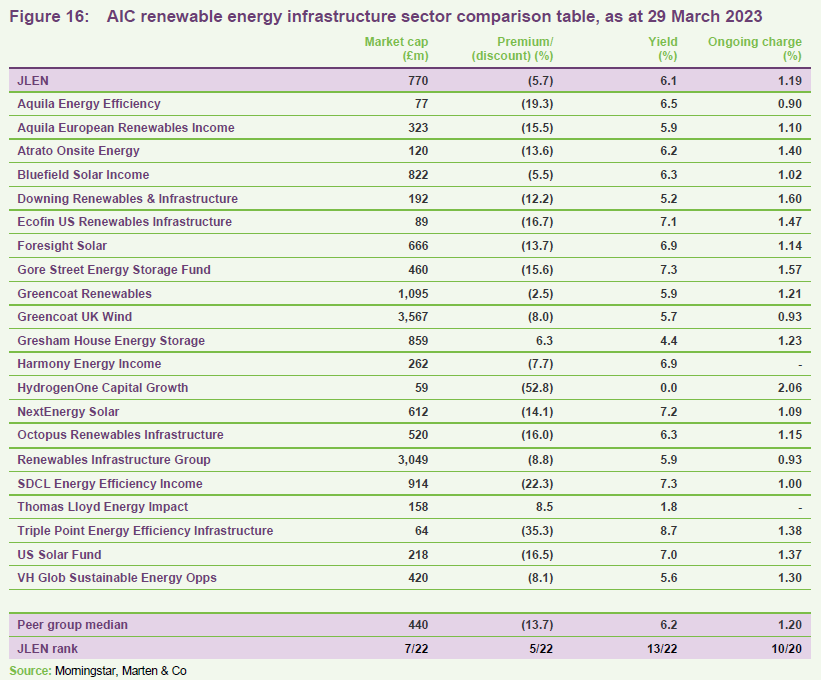

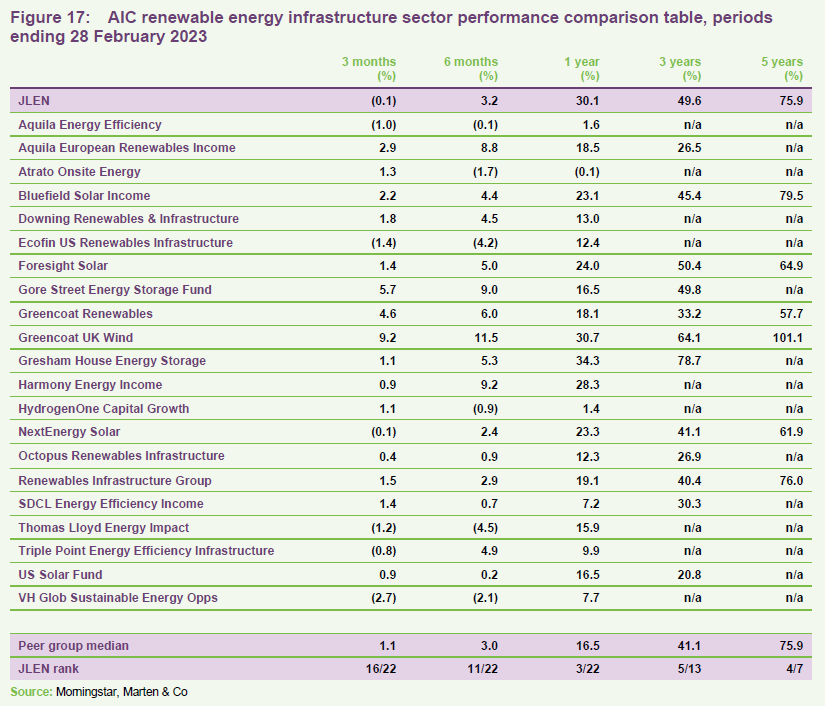

JLEN has one of the broadest remits of the 22 companies that comprise the members of the AIC’s renewable energy sector. Most of these funds are focused on solar or wind or some combination of the two. Three of these funds are focused solely on energy storage.

There is variation of geographic exposure within the peer group too, with a number of funds that are heavily exposed to the North American market (which has a different risk/reward structure) and one focused on Asia.

JLEN is one of the larger funds within this peer group, and while it has de-rated recently, its discount is one of the narrowest in the sector.

Wide discounts have distorted yields across the sector. JLEN’s ongoing charges ratio ranks about middle of the pack.

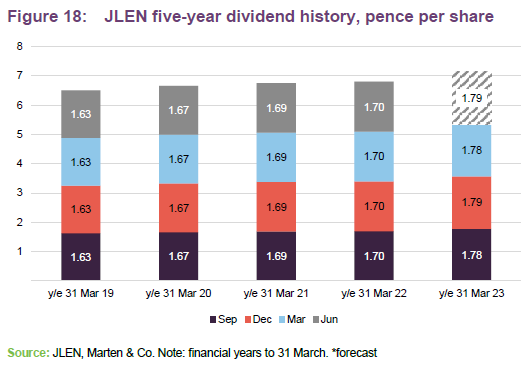

JLEN has a progressive dividend policy. For the accounting year ended 31 March 2023, the board said that it was targeting a total dividend of 7.14p, which implies a fourth-quarter dividend of 1.9p.

At the half-year stage (30 September 2022), JLEN said that its cash dividend cover was running at 1.64x, up from 1.10x for the financial year ended in March 2022.

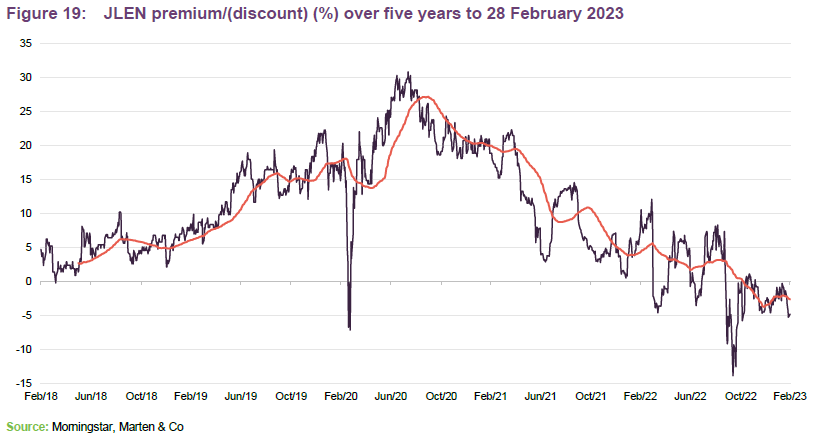

Over the year to 28 February 2023, JLEN’s shares traded in range of a 13.9% discount to NAV to a 12.1% premium, and averaged a premium of 0.5%. At 29 March 2023, JLEN was trading on a discount of 5.7%.

At the company’s AGM on 1 September 2022, shareholders granted permission for both the repurchase of up to 14.99% of JLEN’s then-issued share capital and the issuance of up to 10% of JLEN’s then-issued share capital without pre-emption.

JLEN’s ongoing charges ratio for the year ended 31 March 2022 was 1.19%, down from 1.24% for the prior year.

The managers are entitled to a base fee of 1% on the first £500m of adjusted portfolio value and 0.8% on the balance. There is no performance fee and the manager’s contract can be terminated on one year’s notice.

For the year ended 31 March 2022, in addition to the investment management/advisory fees, directors’ fees and expenses totalled about £297,000 and the administration fee was about £110,000.

JLEN has 661,531,229 ordinary shares in issue and no other classes of share capital. There are no shares held in treasury.

JLEN is domiciled in Guernsey and is listed on the main market of the London Stock Exchange. Investments are carried out through JLEN Environmental Assets Group (UK) Limited, a subsidiary in which JLEN may own both equity and loan notes.

JLEN has an indefinite life, but a discontinuation vote may be triggered if its shares trade at a discount for a prolonged period. The company’s financial year-end is

31 March and AGMs are typically held in August or September.

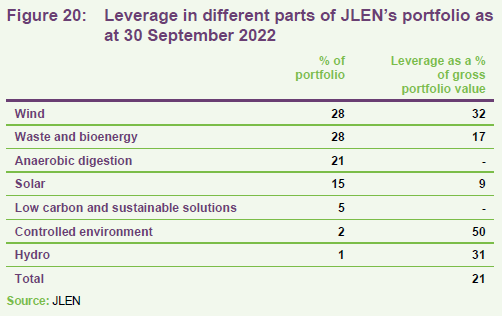

The reliable and predictable cash flows associated with most renewable energy generation support the incorporation of gearing within the capital structures of these funds and/or their projects. Reflecting this, gearing is intrinsic to the investment models applied by JLEN and the majority of its listed peers. JLEN is permitted to borrow up to 30% of its NAV, at the fund level.

JLEN has a £170m committed multi-currency RCF as well as an uncommitted accordion facility of £30m, for borrowing purposes. The facility is provided by National Australia Bank, Royal Bank of Scotland International, ING, HSBC, and NIBC. The RCF matures in May 2024 but has an uncommitted option to allow it to be extended for a further year at JLEN’s discretion. The loan bears interest of SONIA + 195 to 205 bps as the interest charged is linked to JLEN’s ESG performance. JLEN’s interest rate will rise or fall based on performance against defined targets. Those targets include:

As at 30 September 2022, drawings under the RCF were £71.4m.

At the project level, JLEN is constrained to a maximum of 65% gearing on gross project value for renewable energy generation projects and a maximum of 85% gearing on gross project value for PFI/PPP type projects. In practice, actual project gearing is much lower than this.

JLEN disclosed that its largest shareholders as at 31 March 2022 were Gravis Capital Management (7.46%), Newton Investment Management (7.11%) and Evelyn Partners (5.48%).

Chris has been the co-lead investment manager to JLEN since IPO. He joined Foresight in 2019 as a partner and currently works in the London office. He has over 20 years’ of industry experience. Chris is a member of the Institute of Chartered Accountants in England and Wales and has an MA in Politics, Philosophy and Economics from Oxford University.

Chris has been co-lead investment manager to JLEN since January 2018. He joined Foresight in 2019 as a partner in the London office. He has over 23 years’ experience in infrastructure investment and financing in PFI/PPP and renewable energy projects. Chris has a BA (Hons) in Business Economics from the University of Durham.

Edward joined the JLEN management team in 2022. Prior to this, he was head of valuations for Foresight Group and John Laing Capital Management before that. He has over 13 years’ experience in infrastructure and renewable energy projects.

Edward is a qualified Chartered Accountant and holds a BA (Hons) in Business and Management from Oxford Brookes University.

JLEN’s board is currently composed of seven directors, but that will fall back to six very shortly when Richard Ramsay retires from the board. All of the directors are non-executive and considered to be independent of the investment manager.

As we discuss below, a new phase of the board refresh has taken place in recent months.

Richard Morse, the former chair, stepped down from the board on 15 July 2022 and Ed Warner, OBE, replaced him.

Ed brings extensive financial services experience from his time spent in senior positions at several investment banks and financial institutions, including IFX Group, Old Mutual, NatWest Markets, and Dresdner Kleinwort Benson. He also has considerable investment trust experience, having been chair of both Standard Life Private Equity Trust Plc and Blackrock Energy and Resources Income Trust. He is currently chair of HarbourVest Global Private Equity Limited. Ed has also previously served as chair of Air Partner Plc and non-executive director and interim chair of Clarkson Plc.

Richard Ramsay, the last of the directors appointed at IPO, will step down as a non-executive director and senior independent director with effect from 1 April 2023. Following this, Stephanie Coxon will assume the role of senior independent director.

Nadia Sood was appointed to the board on 10 February 2023. Nadia brings extensive experience of executing and managing complex infrastructure investments ranging in size across multiple international markets. She has held a senior role within a Joint Venture with Tata Power, has been a director at Nestlé and is a member of the Governing Council of the IFC/World Bank SME Finance Forum. She is currently the CEO of CreditEnable, an award-winning global credit insights and technology solutions company.

Nadia holds a Bachelor of Science in Foreign Service from The Edmund A. Walsh School of Foreign Service at Georgetown University in Washington DC, and a Masters in International Affairs from Columbia University, New York. She is fluent in English, French and Norwegian.

figure21

Readers interested in further information about JLEN may wish to read our previous notes. You can read the notes by clicking on them in Figure 22 below or by visiting our website.

Figure 22: QuotedData’s previously published notes on JLEN

Source: Marten & Co

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on JLEN Environmental Assets Group Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.

230331 JLEN annual overview IN

This website is for information purposes only and is not intended to encourage the reader to deal in any mentioned securities. QuotedData is a trading name of Marten & Co Limited, which is authorised and regulated by the Financial Conduct Authority. Some of the content in this website is sponsored and, although it abides by Content Principles and Objectives, (/about-quoteddata/research-principles-objectives/) it is considered non-independent. Investments may involve a significant degree of risk, including loss of capital. The value of an investment and the income from it could go down as well as up. The return of your investment is not guaranteed, and you may get back less than you originally invested. Past performance is not an indicator of future performance. It is important that you read the Terms and Conditions (/about-quoteddata/terms-and-conditions/) before considering any investment.

Related Content

JLEN Environmental Assets Investment companies | Annual overview | 31 March 2023 Laying the foundations for NAV growth In common with its peers, JLEN Environmental Assets (JLEN) experienced […]

JLEN Environmental Assets Investment companies | Annual overview | 31 March 2023 Laying the foundations for NAV growth In common with its peers, JLEN Environmental Assets (JLEN) experienced […]

Third quarter of 2022 Kindly sponsored by Baillie Gifford and Aberdeen Standard Investments Piling on the misery In the face of rising inflation, exacerbated by the war in […]

Further portfolio diversification In recent weeks, JLEN Environmental Assets Group (JLEN) has further diversified its portfolio with three new investments, a battery storage project and two investments in […]

Further portfolio diversification In recent weeks, JLEN Environmental Assets Group (JLEN) has further diversified its portfolio with three new investments, a battery storage project and two investments in […]

Further portfolio diversification In recent weeks, JLEN Environmental Assets Group (JLEN) has further diversified its portfolio with three new investments, a battery storage project and two investments in […]

It’s all about renewables The energy sector has reportedly been buoyant over the past 18 months, and the manager of JLEN Environmental Assets (JLEN) thinks that the trust […]

This website is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned.

Please review our cookie, privacy & data protection and terms and conditions policies and, if you accept, please select your place of residence and whether you are a private or professional investor.

You live in…

You are a…

Due to data protection policies, USA residents can not access our data.

Curating your content

Your content has been curated